It is the moment of highest stress.

You just spent $1,000 on a new iPhone. You are excited. Then, the salesperson leans in, looks you in the eye, and asks: “Do you want to add protection for just $9 a month? If you drop it tomorrow, a screen repair costs $400.”

Fear takes over. You imagine your new phone shattering on the sidewalk. You say “Yes.”

For years, I bought the extended warranty on everything—phones, laptops, even washing machines. I thought I was being safe. But recently, I ran the numbers on my “Insurance” spending versus my actual “Repair” spending.

I realized I wasn’t buying safety. I was donating money to tech giants. Here is why I stopped buying extended warranties (and what I do instead).

1. The Casino House Edge

Insurance companies are not charities. They are casinos. They hire actuaries (math experts) to calculate the exact probability of you breaking your phone.

-

The Math: They know that only 15% of people will actually break their screen in 2 years.

-

The Profit: The other 85% of people pay the monthly fee and never use it. That is pure profit.

When you buy AppleCare+ or Geek Squad, you are betting against the house. And the house always wins.

2. The Cost Analysis: AppleCare+ vs. Out-of-Pocket

Let’s look at the real numbers for a standard iPhone (non-Pro).

Scenario A: You Buy AppleCare+

-

Cost: $179 (for 2 years).

-

Deductible: If you break the screen, you still have to pay $29.

-

Total Cost if you break it once: $179 + $29 = $208.

-

Total Cost if you NEVER break it: $179 (Lost money).

Scenario B: You Pay “Out of Pocket”

-

Cost: $0 upfront.

-

Repair Cost: If you break the screen, Apple charges roughly $279 for a repair.

-

Total Cost if you break it once: $279.

-

Total Cost if you NEVER break it: $0.

The Verdict: Yes, if you smash your screen, AppleCare saved you about $70 ($279 – $208). BUT, if you don’t break it, you threw away $179.

You have to break your phone almost every single time to make the math work. If you are a careful person who uses a case, you are losing money.

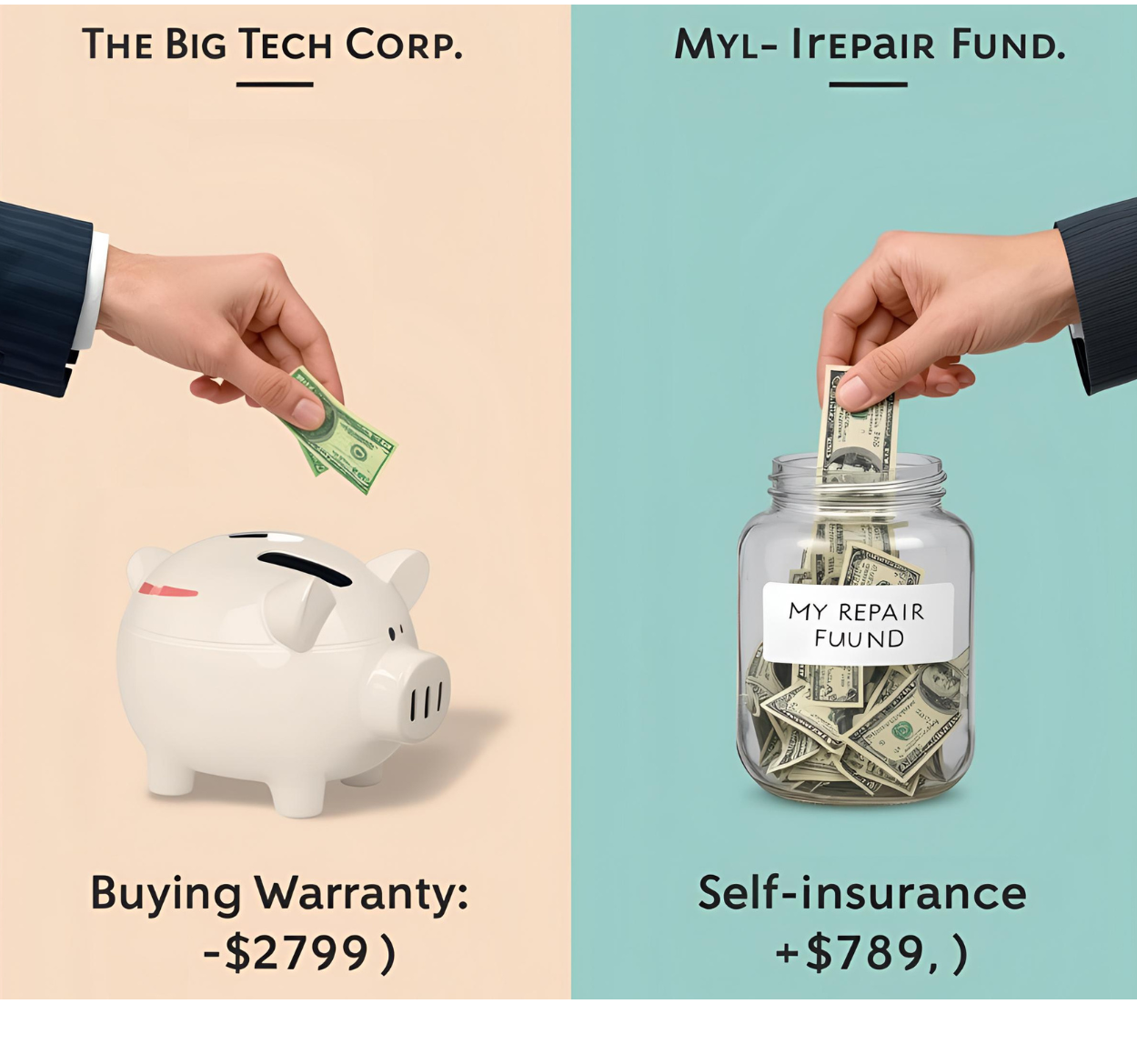

3. The “Self-Insurance” Fund (The Smart Price Strategy)

Instead of giving Apple $9 a month, I now use the “Self-Insurance” Strategy.

-

I have a separate savings account called “Tech Repair.”

-

Every month, I automatically transfer $10 into it (the money I would have paid for insurance).

-

If I break my phone: I use the money in the account to pay for the repair.

-

If I don’t break my phone: I keep the money!

After 5 years of doing this with my phones, laptops, and headphones, I have saved over $1,500. If I break my phone tomorrow, I can pay for the repair cash, and I still have $1,200 left over.

4. When SHOULD You Buy the Warranty? (The Exceptions)

There are two specific times when I do buy the protection:

-

Laptops for Students/Travelers: If you are a college student carrying a laptop in a backpack every day, or a travel photographer, your risk is high. One spill can kill a $2,000 motherboard. In high-risk environments, insurance makes sense.

-

Foldable Phones: If you buy a Galaxy Fold or Pixel Fold, buy the insurance. These screens are fragile, the technology is new, and repairs cost $600+. That is a risk I am not willing to take.

5. The “Case and Screen Protector” Rule

The cheapest insurance isn’t a monthly plan. It is a $15 Case and a $10 Glass Screen Protector.

I am amazed by people who spend $200 on AppleCare but refuse to put a case on their phone because “it looks better naked.” That is financial insanity. A good Spigen or Otterbox case reduces the chance of breakage by 99%.

Conclusion: Don’t Insure Inconveniences

In economics, you should only insure against Catastrophes (things that would ruin your life, like a house fire or a car crash). You should not insure Inconveniences (like a cracked screen).

If you can afford to pay for the repair, don’t buy the insurance. Put that $9/month into your own pocket. Over a lifetime, you will come out thousands of dollars ahead.